Sunday, August 24, 2025

3 min read

Car Finance Court Cases Explained: Why Barnsley Drivers Can Trust anycolourcar.com

Court Cases Have Made Car Buyers Nervous – Let’s Clear It Up

The recent Supreme Court and Court of Appeal cases have dominated headlines across the UK — and left many car buyers in Barnsley and South Yorkshire unsure what it all means.

Are mis-sold PCPs, discretionary commission arrangements, and commission disclosure claims the same thing? Should drivers be worried about using finance to fund their next car?

At anycolourcar.com, we want to cut through the confusion. Here’s what the cases really mean — and why you can still finance your next car with total confidence.

1. Mis-Sold PCP Agreements

A PCP (Personal Contract Purchase) may be mis-sold if:

Balloon payments weren’t explained clearly.

Mileage restrictions weren’t disclosed.

The product wasn’t properly matched to the customer’s needs.

This is about product suitability and advice, not commission.

2. Discretionary Commission Arrangements

Historically, some lenders allowed dealers to set their own commission levels, often by increasing the customer’s interest rate. Unsurprisingly, this led to customers paying more than they needed to.

The Financial Conduct Authority (FCA) banned this practice in January 2021.

3. Commission Disclosure Claims

Customers are entitled to know if a dealer is earning commission on their finance deal. In some cases, this wasn’t made clear, which has led to legal challenges.

What the Court Cases Really Mean for You

Not every finance agreement is affected – many were sold correctly.

Finance today is more transparent thanks to FCA regulation.

Customers are better protected than ever when arranging finance.

In short: while the headlines sound worrying, the reality is that car finance in 2025 is safe, transparent and heavily regulated.

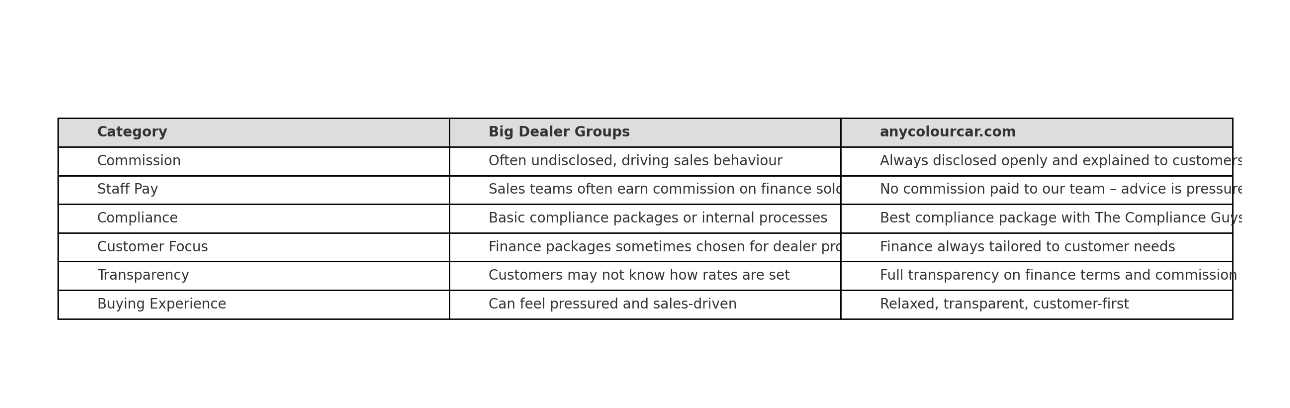

The Real Problem: Commission-Driven Finance

The root of poor practices in the motor trade has often been commission.

Some of the UK’s biggest dealer groups still rely on commission-heavy finance.

This creates bad habits: steering customers into certain products, inflating rates, and prioritising profit over people.

That’s exactly where anycolourcar.com stands apart.

Why anycolourcar.com is Different

We’ve built our business model around compliance and customer outcomes – not commission-driven selling.

✅ We pay for the best compliance package with The Compliance Guys, the UK’s leading motor trade compliance specialists.

✅ We do receive commission on finance deals, but we always disclose this clearly and explain it to customers. Nothing is hidden.

✅ Our team is not paid commission – so there’s no incentive to upsell or push a particular product.

This means when you arrange finance with anycolourcar.com in Barnsley, you can trust that every recommendation is transparent, compliant, and focused solely on your needs.

Consumer Duty: Raising Standards in Car Finance

In July 2023, the FCA introduced the Consumer Duty, replacing the older Treating Customers Fairly (TCF) framework.

The new Consumer Duty goes further, requiring firms to actively deliver good consumer outcomes in every aspect of their business.

This means:

Finance products must offer genuine value.

Customers must receive clear, jargon-free information.

Ongoing support must be provided throughout the finance agreement.

At anycolourcar.com, we already embody this standard:

Our commission is always disclosed and explained openly.

Our team isn’t rewarded for selling finance, but for delivering good outcomes and great service.

We invest in compliance at the highest level, ensuring we always stay ahead of FCA regulation.

We don’t just treat customers fairly — we deliver good consumer outcomes every time.

The Advantages of Point-of-Sale (POS) Dealer Finance

Arranging finance directly at the dealership comes with big benefits compared to personal loans or bank credit:

1. A Dedicated Credit Line for Your Car

Because finance is secured against the vehicle, approvals can be easier to obtain.

2. Easier Access to Finance

We work with a panel of trusted lenders, improving approval chances without multiple applications.

3. Stronger Consumer Protection

Dealer finance is FCA regulated, giving you:

Section 75 protection under the Consumer Credit Act.

Clear disclosure (and in our case, full explanation of commission).

A straightforward complaints process if you ever need it.

4. Access to PCP and HP Products

POS finance gives flexibility with lower monthly payments, upgrade options, and clear end-of-term choices.

5. Fast, Stress-Free Process

At anycolourcar.com, finance can often be arranged the same day, so you could drive away sooner.

A Better Way to Buy a Car

The press may highlight past problems in the industry, but the reality is clear:

Car finance is now better regulated and safer than ever.

Commission-led models created problems — but at anycolourcar.com, we disclose commission openly and ensure it never drives our advice.

By focusing on compliance and good consumer outcomes, we’re aligned with the FCA’s Consumer Duty and committed to putting Barnsley and South Yorkshire drivers first.

Final Thoughts

At anycolourcar.com, we’ve built a culture that’s different to the big dealer groups. By being open about commission and removing it from our team’s pay structures, we’ve created a finance experience that’s transparent, stress-free and genuinely customer-first.

For drivers in Barnsley and across South Yorkshire, that means you can arrange your next car finance with complete confidence.

#anycolourcar #BarnsleyCars #SouthYorkshireDrivers #CarFinanceMadeSimple #CommissionFreeCars #DealerFinance #TransparentCarFinance

anycolourcar Limited is registered in England and Wales under company number: 12573459. Genn Lane, Barnsley, S70 6TF. anycolourcar Limited is authorised and regulated by the Financial Conduct Authority, under FCA number: 946186. We act as a credit broker not a lender. We work with a number of carefully selected credit providers who may be able to offer you finance for your purchase. (Written Quotation available upon request). Whichever lender we introduce you to, we will typically receive commission from them (either a fixed fee or a fixed percentage of the amount you borrow) and this may or may not affect the total amount repayable. The lender will disclose this information before you enter into an agreement which only occurs with your express consent. The lenders we work with could pay commission at different rates and you will be notified of the amount we are paid before completion. All finance is subject to status and income. Terms and conditions apply. Applicants must be 18 years or over. We are only able to offer finance products from these providers. As we are a credit broker and have a commercial relationship with the lender, the introduction we make is not impartial, but we will make introductions in line with your needs, subject to your circumstances. anycolourcar Limited are registered with the Information Commissioners Office under registration number: ZA863807

Showroom: The Old Garage, Genn Lane, Worsbrough, Barnsley, S70 6TF.

Service Centre: Stairfoot Business Park, Bleachcroft Way, S70 3PA

Email : hello@anycolourcar.com- Monday

- Tuesday

- Wednesday

- Thursday

- Friday

- Saturday

- Sunday

- 09:00 - 18:00

- 09:00 - 18:00

- 09:00 - 18:00

- 09:00 - 18:00

- 09:00 - 18:00

- 09:00 - 17:00

- CLOSED

2026 anycolourcar.com. All rights reserved

Powered by Motorsales.ai - Innovating the future of car sales